City College is introducing a program that would allow instructors, staff and managers to retire early in a move that could save the college money.

The program, called Supplemental Early Retirement Program, requires applicants to be older than 55, and working for the college for a minimum of 10 years.

“They [SERP] take 70 percent of faculty, staff base salary, then they get the choice to span it for five or even 10 years,” says Elizabeth Auchincloss, president of California School Employee Association.

The program is a response to the excessive drop in enrollment since the 2015-2016 school year. Salaries and benefits make up over 80 percent of City College’s expenses. Early retirement is a way to save the college money, college officials said.

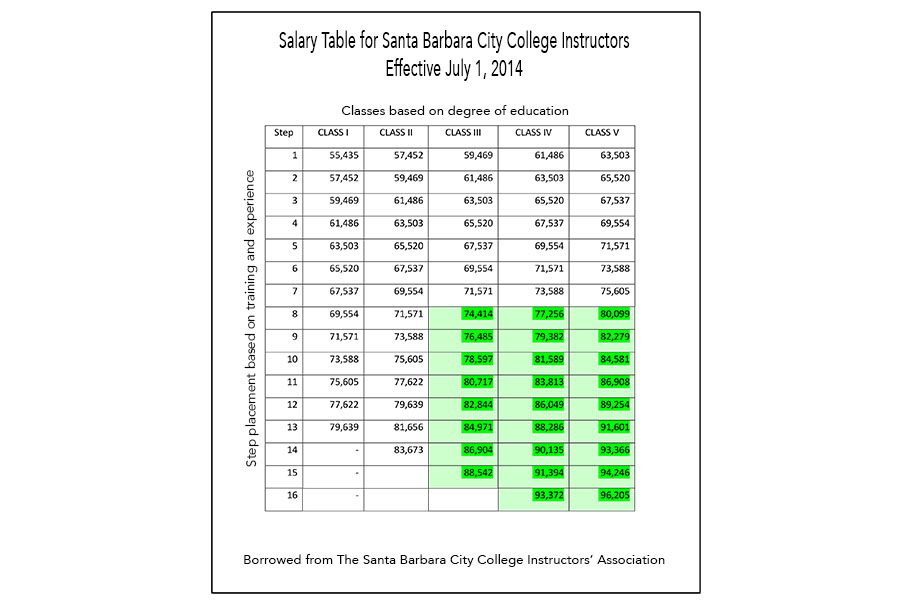

A professor who has been with the college for more than 10 years could be getting a yearly salary of over $100,000, whereas the starting salary, even for the highest paid, is still about $30,000 less.

College officials predict that City College will not rise back to its former size, at least in the foreseeable future. To cope with the decrease in student enrollment and the 3% attrition rate, which is not ample, the program will help reduce the number of instructors, faculty and staff without laying anyone off.

The program is a way for the college to shrink both its size and expenses.

Enrolling will not change the applicant’s previous benefits from the California State Teachers’ Retirement Program, or the California Public Employees’ Retirement System and faculty salary includes longevity because of their dedication to the college, Auchincloss said.

Kaplan International’s early departure in spring was a $1 million hit to City College. The program, if people are accepted, is sure to save the college money. However the amount the will not be certain until after the Nov. 29 registration deadline, Financial Services Controller Lyndsay Maas said.

Keenan & Associates, the largest privately held insurance firm is the representative for the program Maas said. The organization provides financial services, brokerages, consulting services, and specializes in public agencies, such as schools and hospitals.

Representatives from Keenan & Associates spent this week at City College meeting with groups and individuals who are interested enrolling in the program, or have any questions.

“It’s still early for anyone to sign up, but the survey shows a lot of interest,” said Auchincloss. “We won’t know for sure until after the signup period.”

The anonymous survey was created by employee groups in August, and distributed amongst the entire campus.

The deadline to apply for the Supplemental Early Retirement Program is Nov. 29, for those who want to officially retire on January 31, or June 30 of 2017.